What is Green Finance, and how the Singapore Green Finance Centre will fuel its growth

What is Green Finance, and how the Singapore Green Finance Centre will fuel its growth

By SMU City Perspectives team

Published 9 June, 2021

Doing well by doing good. Companies that focus on ESG issues can perform better if unexpected events occur.

Dave Fernandez

Professor of Finance

In brief

- Due to large populations experiencing a climate crisis, increased attention to climate risk and its impact on social activity has been observed. Sustainable finance ensures investments support the economy and help markets recover from this.

- SMU’s Lee Kong Chian School of Business and the Imperial College Business School (ICBS) have joined forces to launch the Singapore Green Finance Centre (SGFC)—Singapore’s first research institute dedicated to green finance research and talent development.

- The SGFC will spearhead green finance growth in three ways: 1) nurturing new talent, 2) building an Asian green finance hub and 3) developing a regulatory framework. These will be made possible by drawing on the respective expertise of ICBS and SMU in climate science, financial economics, and sustainable investing.

Last Update: 06 June, 2024

Historically, big business and capitalism have been regarded as accelerators of climate change: From “the great smog of London” arising from the Industrial Revolution (powerfully depicted in Netflix series The Crown), to currently unsustainable livestock practices that—according to the United Nations—contribute 14.5 per cent of all greenhouse gas emissions from human activity.

"Climate matters are the way of the future and there is no escaping it."

While a handful of world leaders and business moguls may be in denial about environmental and social crises on a global level, some of whom have dubbed climate change “a hoax”, a fast-growing sector of finance is catching up on to how capital markets and innovative private sectors can empower—not deter—positive impact.

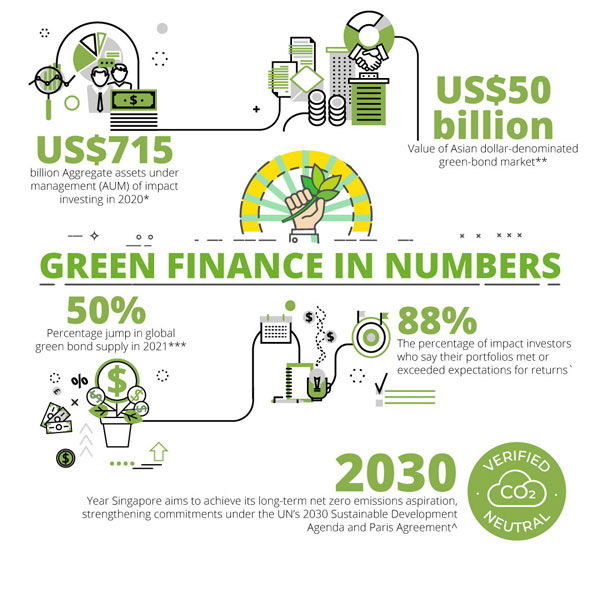

And the numbers increasingly point towards environmental, social, and governance (ESG) strategies as a disrupter in investment opportunities: According to a 2020 survey by The Global Impact Investing, the aggregate assets under management (AUM) of impact investing has increased from US$502 billion in 2019 to US$715 billion the following year. Recent academic research by Krueger, Sautner, and Starks (2019) also showed that institutional investors increasingly believe climate risks may implicate the financial performance of investment portfolios.

Source:

*Global Impact Investing Network (GIIN) 10th Annual Survey

**HSBC “Asia’s green finance booms” report

***NN Investment Partners global green bond market forecast 2020

`GIIN “Impact Investing Decision-making: Insights on Financial Performance” report

^Singapore Green Plan 2030

Moreover, recent climate crises experienced by large populations—such as the recent deep freeze in Texas—have led to an increase in attention on climate risk and its impact on social activity. Sustainable finance therefore ensures investments support a resilient economy and help markets recover from such catastrophic events.

“There is increasing attention to climate change and the current global pandemic crisis emphasises the need to equip people with the ability to deal with uncertain environmental, economic, and political changes,” says Professor of Finance (Practice) Dave Fernandez, Director of Singapore Management University’s (SMU) Sim Kee Boon Institute for Financial Economics.

With the triple bottomline being a lucrative and even necessary approach for investment plays of tomorrow, rigorous research and evidence-based data will form the foundation of impact investment growth. As such, SMU’s Lee Kong Chian School of Business and the Imperial College Business School have joined forces to launch the Singapore Green Finance Centre (SGFC)—Singapore’s first research institute dedicated to green finance research and talent development.

To strengthen this fast-emerging field of green finance, the SGFC will draw on the respective strengths of Imperial and SMU in climate science, financial economics, and sustainable investing. This triple threat of expertise lies at the core of a fast-growing, but still nascent ecosystem, engineered to propel Asia’s transition into a carbon-free future.

1. Capacity building for the next generation: Nurturing talent in the specific field of green finance

While financial capital is an obvious driver for achieving sustainability goals, human capital is as essential an asset for upholding long-term ESG principles. Developing a strong human capital model with the know-how to align environmental, business, societal and financial objectives will be in high demand to ensure that Asia is able to meet the requirements for becoming an epicentre for sustainable investing.

The SGFC is poised to develop various talent development opportunities for both professionals in the current workforce and undergraduates—providing capacity building in the next generation, beginning with SMU students. Whether at the undergraduate, postgraduate or executive level, upskilling of current capabilities is necessary for the progression of society. Adds Prof Fernandez: “This will allow the workforce to shift their attention to greener activities and more sustainable decisions which are beneficial in the long term.” A key objective is to equip employees with skill sets required to navigate international standards and government policies, such as UN Sustainable Development Goals 2030, the SG Green Plan 2030, and the Paris Climate Agreement—a legally binding international treaty on climate change.

Meeting these goals requires continued support and contribution from all parties. Financial industries, as important participants in the market, play a crucial role in providing the investment and helping shape a low-carbon economy.

2. An Asian epicentre of green finance

Going by the fast-paced growth in demand for ESG and sustainable investment products—as demonstrated by the US$50 billion Asian dollar-denominated green-bond market—the region is well-placed as a hotspot for green finance. And SGFC is focused on leading the green finance conversation in the Asian region—in part led by multi-disciplinary research that will enable financial institutions, corporates, and policymakers to improve the management of environmental risks, develop financial solutions to promote environmental sustainability, and design policies for a sustainable future. As Susan Soh, Co-Head of Asia Pacific and CEO Singapore for Schroder Investment Management, said at the panel session of “Endowus Insights 2021: Paving a New Way Forward” webinar: “We want to bring our industry insights to do co-research with the centre–by identifying climate risk and problem statements that our investment community is struggling with. And hopefully, we will publish white papers from there. I hope to tie up our graduate trainee programme with the SGFCs courses and eventually giving employment opportunities to your graduates.” SGFC led the sessions on Green Finance for Module 2 of SMU’s Growing Infrastructure Executive Programme. The programme is targeted at senior and mid-level decision-makers and policymakers in the infrastructure sector from South and South East Asia, and the course is developed as a tripartite collaboration between SMU’s Sim Kee Boon Institute, Infrastructure Asia and the World Bank Group. Aimed at supporting regional infrastructure development and raising participants’ awareness of solutions from Singapore-based companies, the programme allows Singapore to lead conversations in this area, while pulling the rest of developing Asia along with it. Armed with scientific analysis and data, SGFC will conduct independent research in evaluating the ESG performance in Asia. With this Asian perspective in mind, the research outputs will likely be more well-suited for developing Asia. The SGFC will also roll out online courses and Asian-focused case studies that will better equip and educate the sector. “There is a view of ‘doing well by doing good’,” says Prof Fernandez. “Companies that focus on ESG issues can perform better if unexpected events occur.”

Methodology & References

- Key facts and findings. Food and Agriculture Organization of the United Nations. Retrieved from

{https://www.fao.org/news/story/en/item/197623/icode/} - Mason, J. (2019). Trump, on climate, says he won't jeopardize U.S. wealth on 'dreams'. Reuters. Retrieved from

{https://www.reuters.com/article/us-g7-summit-trump-climatechange-idUSKCN1VG1RU} - Forbes. Retrieved from

{https://www.forbes.com/sites/annefield/2020/06/16/with-715b-in-aum-impact-investors-stay-the-course-despite-the-pandemic-says-the-giin/?sh=4d4e01e26d3c} - Krueger, P., Sautner, Z., Starks, L. (2019). The Importance of Climate Risks for Institutional Investors. Swiss Finance Institute Research Paper No. 18-58 European Corporate Governance Institute - Finance Working Paper No. 610/2019 Retrieved from

{https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3235190} - The Singapore Green Finance Centre is an initiative of Imperial College Business School and Singapore Management University, backed by the Monetary Authority of Singapore and leading global financial institutions. Singapore Green Finance Centre. Retrieved from

{https://www.singaporegreenfinance.com/} - Global Research. HSBC. Retrieved from

{https://www.gbm.hsbc.com/en-gb/campaigns/global-research} - Reuters (2020). Global green bond supply to jump 50% in 2021 – NN IP. Nasdaq. Retrieved from

{https://www.nasdaq.com/articles/global-green-bond-supply-to-jump-50-in-2021-nn-ip-2020-12-22} - Impact Investing Decision Making Insights on Financial Performance. GIIN. Retrieved from {https://thegiin.org/assets/Impact%20Investing%20Decision%20making_Insights%20on%20Financial%20Performance.pdf}

- Green Plan. Green Plan. Retrieved from

{https://www.greenplan.gov.sg/splash}